It's almost February!

Here's our @zumper monthly rent report

Let's start with a big surprise

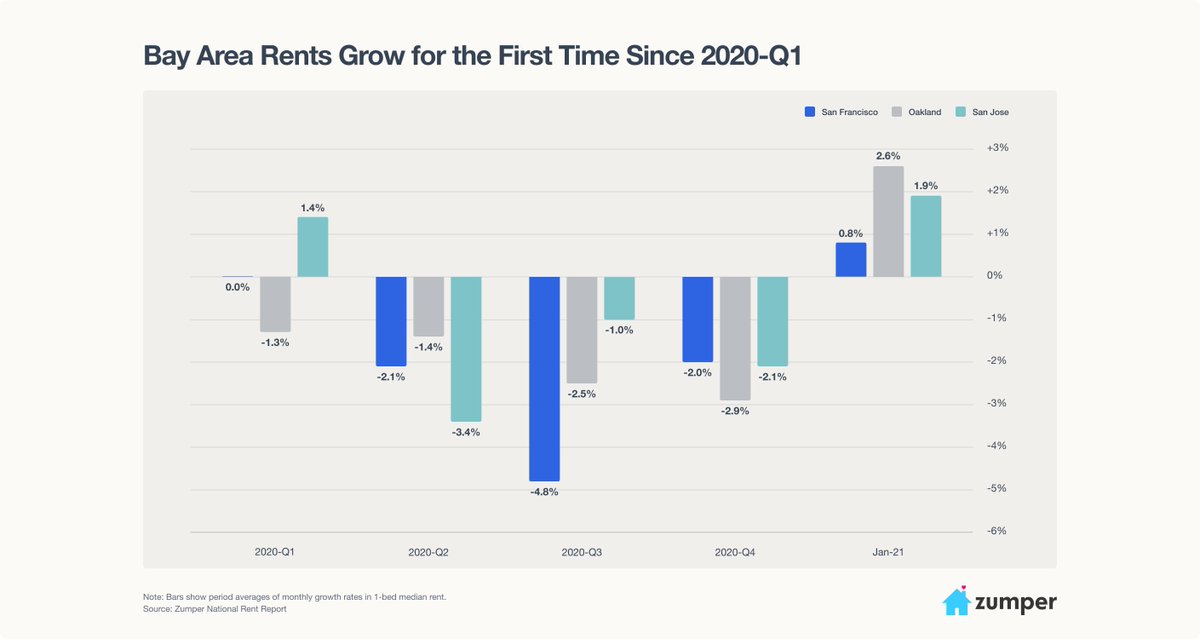

SF rents were 0.8% month on month as some people returned to the city in Jan

0.8% month on month as some people returned to the city in Jan

SF is still down 23.9% annually, so no change to the overall theme

Here's our @zumper monthly rent report

Let's start with a big surprise

SF rents were

0.8% month on month as some people returned to the city in Jan

0.8% month on month as some people returned to the city in Jan

SF is still down 23.9% annually, so no change to the overall theme

The most expensive US cities' 1BR median rents held steady in their large declines

NYC actually fell further, coming close to the sizable SF % drop

23.9% in SF

23.9% in SF

21.7% in NYC

21.7% in NYC

14.2% in LA

14.2% in LA

19.0% in Oakland

19.0% in Oakland

NYC actually fell further, coming close to the sizable SF % drop

23.9% in SF

23.9% in SF 21.7% in NYC

21.7% in NYC 14.2% in LA

14.2% in LA 19.0% in Oakland

19.0% in Oakland

As we've seen before, the migration to cousin cities in the same state but with lower costs of living has continued, delivering *significant* rent price increases in those geos:

31.6% in Newark

31.6% in Newark

7.7% in Sacramento

7.7% in Sacramento

10.0% in Fresno

10.0% in Fresno

31.6% in Newark

31.6% in Newark 7.7% in Sacramento

7.7% in Sacramento 10.0% in Fresno

10.0% in Fresno

What's so cool about running a rental platform is watching these trends emerge in real-time

The rental market is incredibly dynamic; the for sale market is slower and has a larger lag time

The rental market is incredibly dynamic; the for sale market is slower and has a larger lag time

Based on what we see in our Zumper MAUs, we don't expect any of these trends to materially reverse until post vaccine, say late summer 2021

We will then see the Great Reshuffle

(credit: @Rich_Barton for coining)

We will then see the Great Reshuffle

(credit: @Rich_Barton for coining)

The Great Reshuffle will define the next decade of rental & demographic trends

If I had to guess:

- Major cities will recover

- But not to pre-pandemic levels

- So no more $3,700 SF 1BR rents

- Remote work continues for many

- And so secondary & tertiary cities thrive

If I had to guess:

- Major cities will recover

- But not to pre-pandemic levels

- So no more $3,700 SF 1BR rents

- Remote work continues for many

- And so secondary & tertiary cities thrive

I'm personally really excited for this new way of working

As the CEO of a tech company, it allows us to attract & hire incredible and diverse talent across the US

And there are several cities outside the Bay Area who are courting us & every other startup to do this

As the CEO of a tech company, it allows us to attract & hire incredible and diverse talent across the US

And there are several cities outside the Bay Area who are courting us & every other startup to do this

I feel this way about that https://twitter.com/anthemos/status/1349860914036576258

Read on Twitter

Read on Twitter