Easily to follow thread on $IMMR

@EnoviceR @JonahLupton @mchaudhry82 @Nick_HuynhMPLS @InvestorWisdom @MarketChmln @thetradejourney @GetBenchmarkCo @antoniovelardo_ @saxena_puru

@EnoviceR @JonahLupton @mchaudhry82 @Nick_HuynhMPLS @InvestorWisdom @MarketChmln @thetradejourney @GetBenchmarkCo @antoniovelardo_ @saxena_puru

It sells its IP to four main segments:

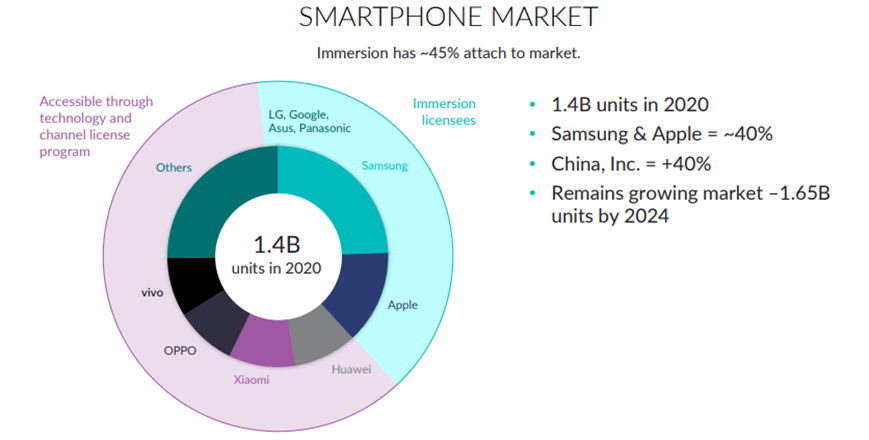

It sells its IP to four main segments:Mobile (accounts for 70% of their revenue)

Gaming

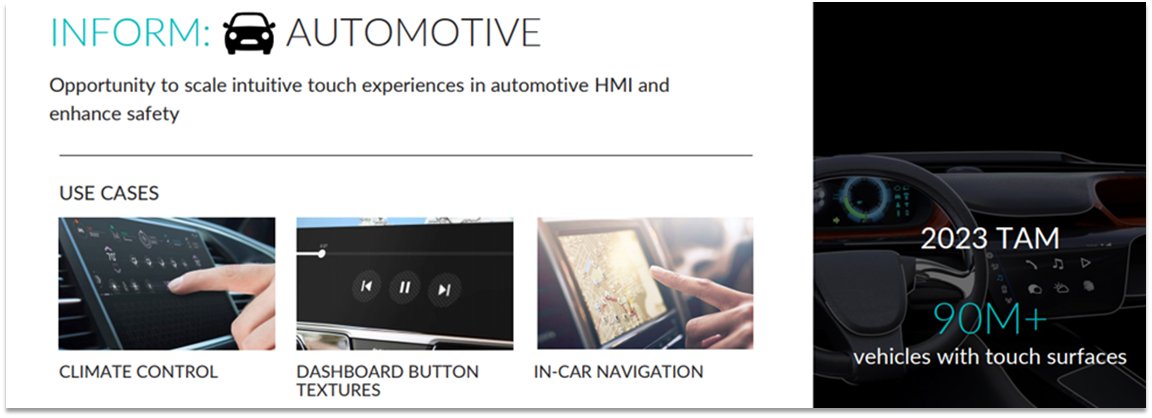

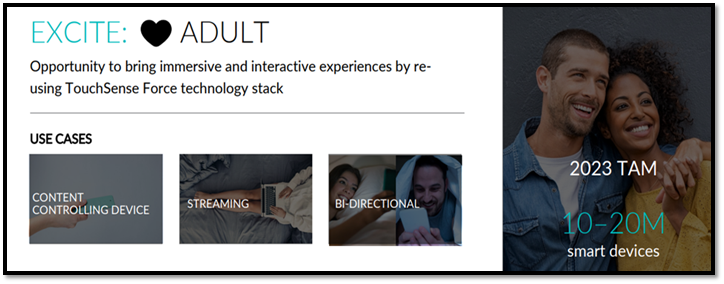

Automobile

Adult Entertainment

All of these segments are projected to have large TAM by 2023

The recent catalyst for the firm has been the #PS5

The recent catalyst for the firm has been the #PS5  controller, which has been applauded by the customer for its immersive experience via haptics and adaptive triggers

controller, which has been applauded by the customer for its immersive experience via haptics and adaptive triggersCheck the video below to see what we mean

https://www.youtube.com/results?search_query=Ps5+controller+guns

PS4 cumulative Sales since launch has been 110+ Million, we can expect the sales of PS5 to be similar in the next 6 years.

PS4 cumulative Sales since launch has been 110+ Million, we can expect the sales of PS5 to be similar in the next 6 years. A customer would buy more than one controller. 1) Replacement after wear and tear, 2, controller breaking down 3) To play multiplayer games with friends

A customer would buy more than one controller. 1) Replacement after wear and tear, 2, controller breaking down 3) To play multiplayer games with friends

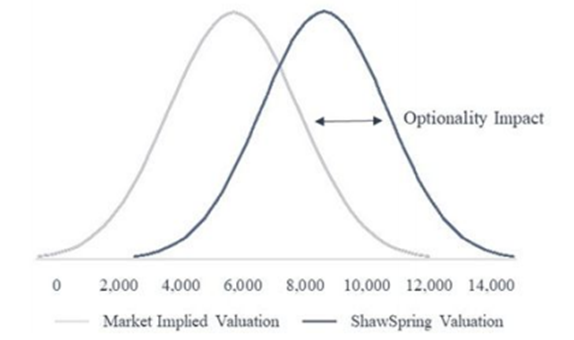

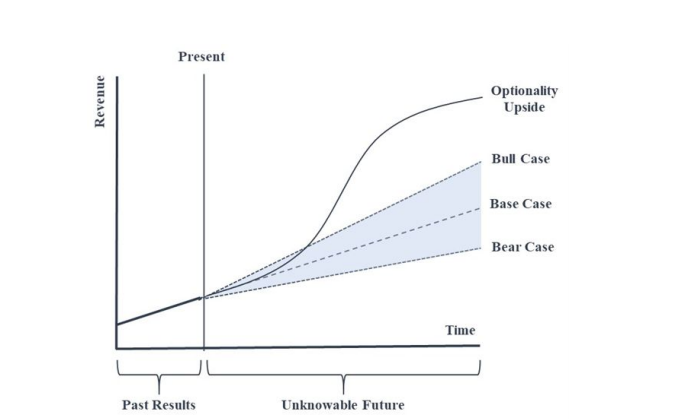

The company has amazing optionality. Optionality is a future stream of returns that is unknowable or difficult to decode for the market at the current stage.

The company has amazing optionality. Optionality is a future stream of returns that is unknowable or difficult to decode for the market at the current stage.Nice framework by ShawspringPatners to understand this @DennisHong17

Possible sources of optionality

Controller Adopted by PC gamers

Controller Adopted by PC gamers

Microsoft can adopt this for XBOX – Head already Interested!

Microsoft can adopt this for XBOX – Head already Interested!

$TSLA using haptic for its steering wheel

$TSLA using haptic for its steering wheel

5G Mobile Replacement Cycle

5G Mobile Replacement Cycle

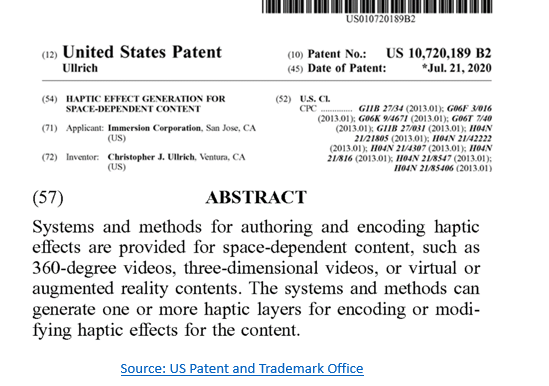

AR/VR Gaming – Oculus/PSVR 2 – They have IP

AR/VR Gaming – Oculus/PSVR 2 – They have IP

Controller Adopted by PC gamers

Controller Adopted by PC gamers Microsoft can adopt this for XBOX – Head already Interested!

Microsoft can adopt this for XBOX – Head already Interested!  $TSLA using haptic for its steering wheel

$TSLA using haptic for its steering wheel 5G Mobile Replacement Cycle

5G Mobile Replacement Cycle AR/VR Gaming – Oculus/PSVR 2 – They have IP

AR/VR Gaming – Oculus/PSVR 2 – They have IP

Investment Thesis

The company drastically lowering OpEx from to $17-19M a year

The company drastically lowering OpEx from to $17-19M a year

99.5% gross margin with low OpEx – tremendous operating leverage

99.5% gross margin with low OpEx – tremendous operating leverage

PS5 bonanza and optionality

PS5 bonanza and optionality

Recovery in automotive and mobile industry post-COVID

Recovery in automotive and mobile industry post-COVID

Continued

The company drastically lowering OpEx from to $17-19M a year

The company drastically lowering OpEx from to $17-19M a year  99.5% gross margin with low OpEx – tremendous operating leverage

99.5% gross margin with low OpEx – tremendous operating leverage PS5 bonanza and optionality

PS5 bonanza and optionality Recovery in automotive and mobile industry post-COVID

Recovery in automotive and mobile industry post-COVIDContinued

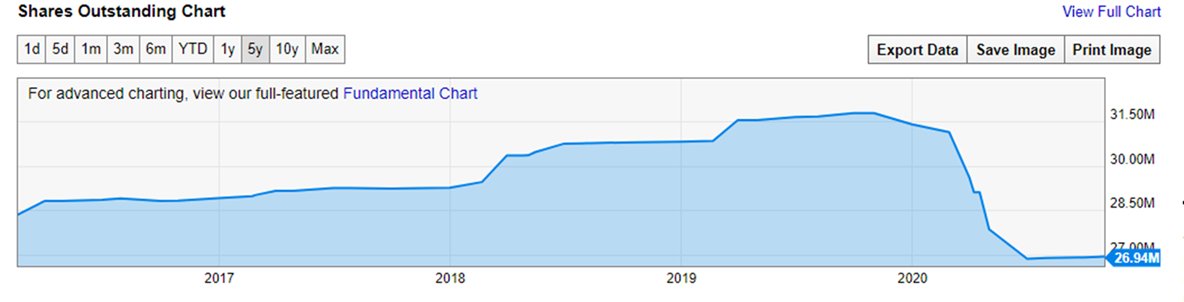

In 2020 the company spent $30.6M to buy back 4.9M shares. This can be repeated due to improved operating leverage (see chart)

In 2020 the company spent $30.6M to buy back 4.9M shares. This can be repeated due to improved operating leverage (see chart) Under the radar vs other hype stocks

Under the radar vs other hype stocks Increasing shift to recurring revenue model – example Royalty (per unit)

Increasing shift to recurring revenue model – example Royalty (per unit)

Risks

Insider Selling

Insider Selling

Mobile 74% of revenues. The industry is Saturated. Growth is coming from China, which they don't cater as such

Mobile 74% of revenues. The industry is Saturated. Growth is coming from China, which they don't cater as such

Continued

Insider Selling

Insider Selling

Mobile 74% of revenues. The industry is Saturated. Growth is coming from China, which they don't cater as such

Mobile 74% of revenues. The industry is Saturated. Growth is coming from China, which they don't cater as suchContinued

Haptic can also be internally developed and easily replicated

Haptic can also be internally developed and easily replicated

In the past, IP development didn’t translate into revenue growth/paying customers.

In the past, IP development didn’t translate into revenue growth/paying customers.

What happens when fixed contracts with Apple/Nintendo/Sony expires?

What happens when fixed contracts with Apple/Nintendo/Sony expires?

If you like this thread you are going to love our detailed video analysis here:

Join our investor telegram chat to generate investment ideas - http://t.me/joinchat/J90VA

Don't forget to RT. Sharing is caring.

Join our investor telegram chat to generate investment ideas - http://t.me/joinchat/J90VA

Don't forget to RT. Sharing is caring.

Read on Twitter

Read on Twitter