Larry Summers really stepped in it when he questioned why the govt would think about 'giving' Americans $2000 instead of $600.

That wasn't really the problem, though that's what got him in enough trouble he had wrote an entire Bberg op-ed. https://www.bloomberg.com/opinion/articles/2020-12-27/larry-summers-trump-pelosi-2-000-stimulus-checks-are-a-mistake

That wasn't really the problem, though that's what got him in enough trouble he had wrote an entire Bberg op-ed. https://www.bloomberg.com/opinion/articles/2020-12-27/larry-summers-trump-pelosi-2-000-stimulus-checks-are-a-mistake

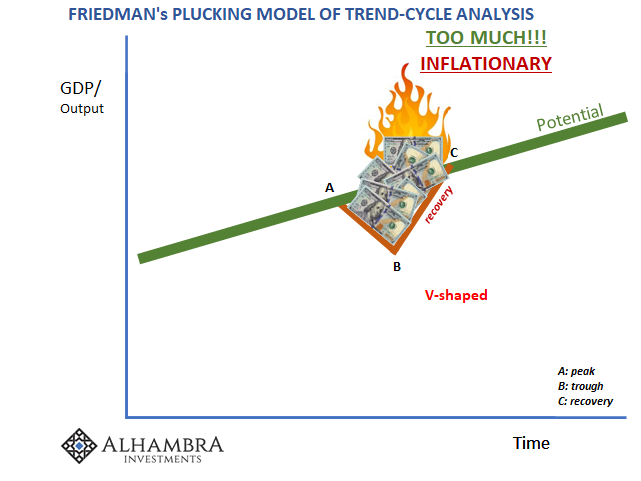

Summers' real beef is a familiar Keynesian-inflationary argument that we've heard (obnoxiously) for more than a decade. Aggregate demand.

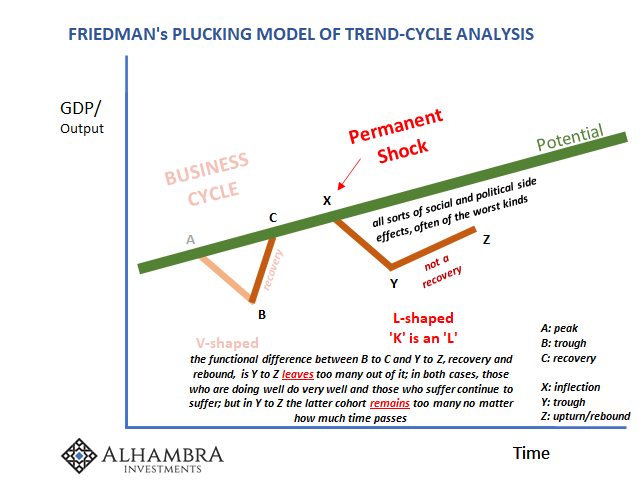

Economists believe there are no permanent shocks, therefore a trough leads to guaranteed recovery - as in 2021. https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

Economists believe there are no permanent shocks, therefore a trough leads to guaranteed recovery - as in 2021. https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

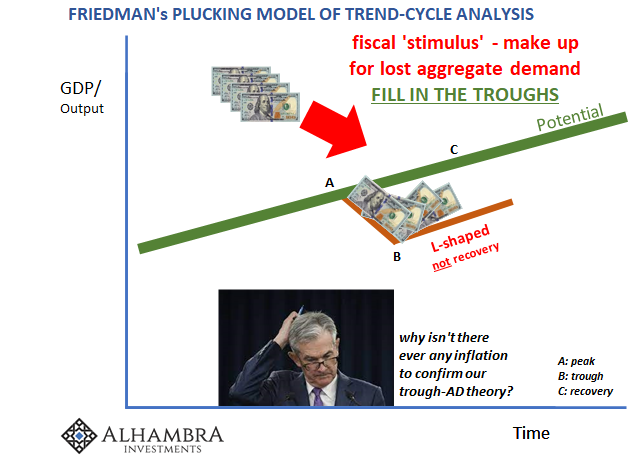

If fiscal and monetary policy is nothing more than a means to "fill in the trough" to mitigate recession effects, then this risks the "too much" scenario which is were Larry Summers was objecting.

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

Ever since the last time, 2008-09, this theory has left predictions for wild inflation unfulfilled. Rather than figure out why, even Economists like Larry Summers began to speculate about "stagnation."

Yes, but from what? And what does that mean 2021?

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

Yes, but from what? And what does that mean 2021?

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

If there are and have been permanent shocks (spoiler: there have been) then there is no "too much" just like there didn't end up being too much the last time we did all these same things.

Just like Japan.

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

Just like Japan.

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

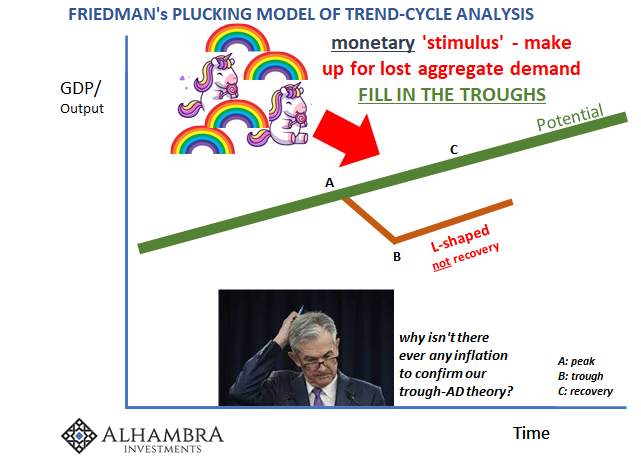

Final note for the record; the Fed's part in all of this so far as "stimulus" and filling in the trough/aggregate demand is concerned doesn't have dollars in it.

On the contrary, "monetary" policy is realistically depicted like this:

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

On the contrary, "monetary" policy is realistically depicted like this:

https://alhambrapartners.com/2020/12/29/the-summer-slowdown-collides-with-the-summers-acceleration-theory/

Read on Twitter

Read on Twitter