1/8

Congratulations to Largo Resources for their move into VRFB. Some rather bold calls on cost competitiveness, which I find difficult to believe.

However, whats key is more existing V supply, slowly moving away from its traditional steel markets.

#BMN https://www.largoresources.com/investors/news/press-release-details/2020/Largo-Resources-Launches-Largo-Clean-Energy-Creating-a-Leading-Vertically-Integrated-and-Sustainable-Renewable-Energy-Storage-Provider/default.aspx

Congratulations to Largo Resources for their move into VRFB. Some rather bold calls on cost competitiveness, which I find difficult to believe.

However, whats key is more existing V supply, slowly moving away from its traditional steel markets.

#BMN https://www.largoresources.com/investors/news/press-release-details/2020/Largo-Resources-Launches-Largo-Clean-Energy-Creating-a-Leading-Vertically-Integrated-and-Sustainable-Renewable-Energy-Storage-Provider/default.aspx

2/

Adding to the demand pressure, over the coming years.

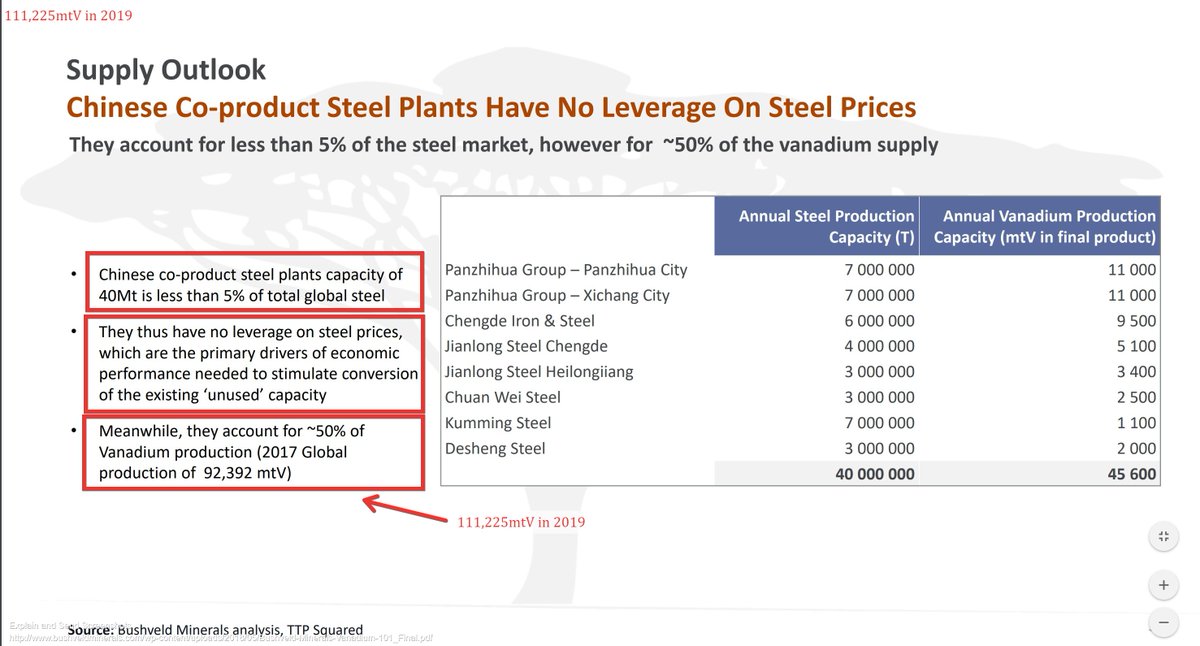

Important not to forget the limitations of steel co-producer supply, as demonstrated by this BMN slide (China only).

Whilst now more than 2 years old, it demonstrates just how concentrated Chinese V co-production is.

Adding to the demand pressure, over the coming years.

Important not to forget the limitations of steel co-producer supply, as demonstrated by this BMN slide (China only).

Whilst now more than 2 years old, it demonstrates just how concentrated Chinese V co-production is.

3/

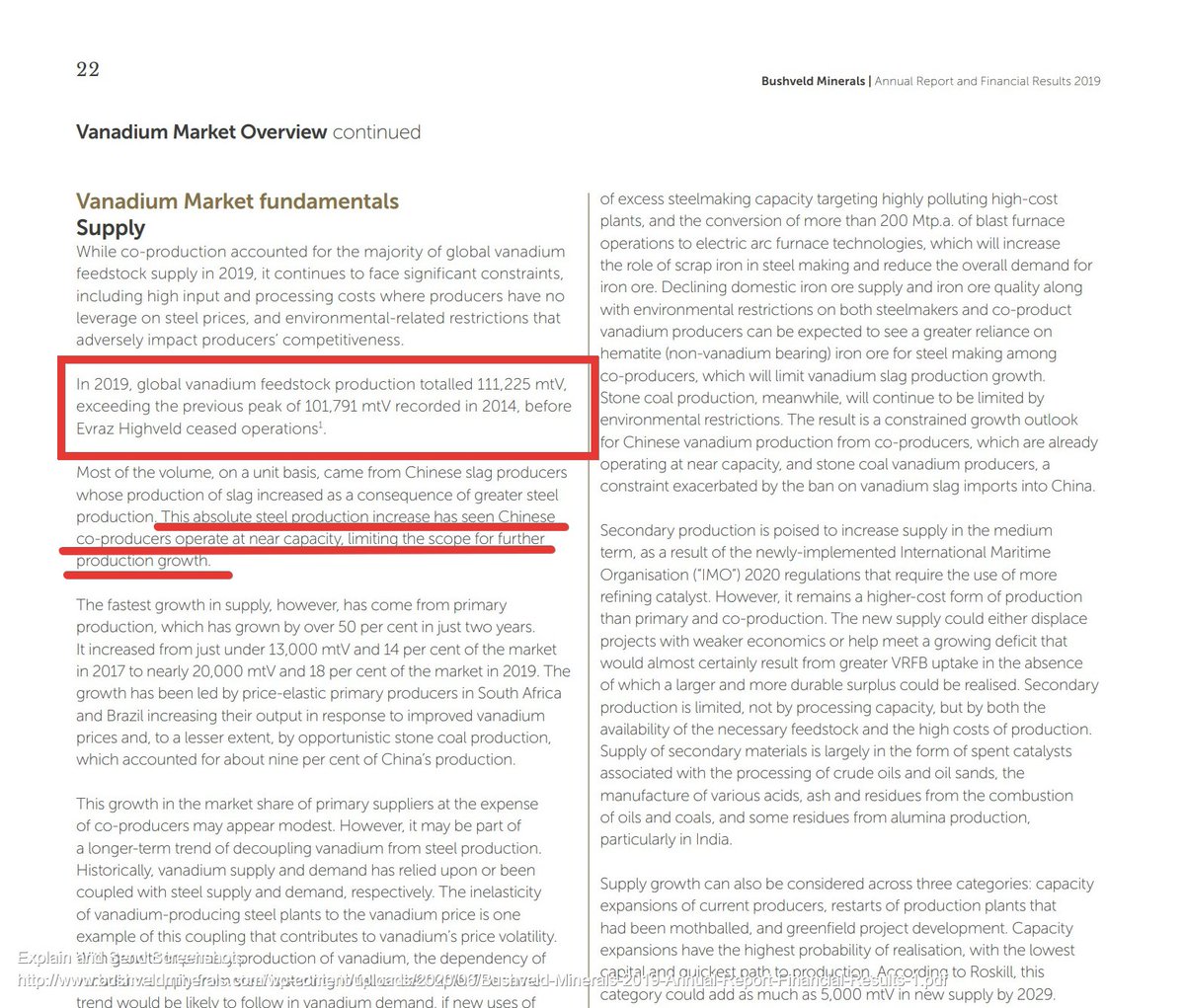

50% of world production (today 41%), coming from less than 5% of total global steel supply.

Many may hear Chinese steel plant co-production and assume its spread over many producers but it isn't.

These plants are already at near full capacity and so its inelastic supply.

50% of world production (today 41%), coming from less than 5% of total global steel supply.

Many may hear Chinese steel plant co-production and assume its spread over many producers but it isn't.

These plants are already at near full capacity and so its inelastic supply.

4/

So in a world where now 3 of the only 4 pure play vanadium producers, are supporting VRFB companies with guaranteed supply, at prices that support rapid expansion, then its easy to see that non steel related demand (VRFBs), is going to push higher.

So in a world where now 3 of the only 4 pure play vanadium producers, are supporting VRFB companies with guaranteed supply, at prices that support rapid expansion, then its easy to see that non steel related demand (VRFBs), is going to push higher.

5/

That demand has nothing to do with the core business of those steel plants. So their V output won't change.

If their core steel markets come under pressure, then so does their outputs and the overall market highly likely sees an overreaction on vanadium supply reductions.

That demand has nothing to do with the core business of those steel plants. So their V output won't change.

If their core steel markets come under pressure, then so does their outputs and the overall market highly likely sees an overreaction on vanadium supply reductions.

6/

The greater that VRFBs expand, the more of the overall % demand they take up and the less impact steel demand has on things.

So we see greater V demand, potentially coupled with falling supply.

However, with all this Covid recovery infrastructure being planned,

The greater that VRFBs expand, the more of the overall % demand they take up and the less impact steel demand has on things.

So we see greater V demand, potentially coupled with falling supply.

However, with all this Covid recovery infrastructure being planned,

7/

the likelihood is greater steel demand and a market pulling in 2 directions, with a very large percentage (71% in 2019), unable to adjust its supply significantly.

Largo's CEO calls their move a "forward-thinking approach," which it is.

the likelihood is greater steel demand and a market pulling in 2 directions, with a very large percentage (71% in 2019), unable to adjust its supply significantly.

Largo's CEO calls their move a "forward-thinking approach," which it is.

8/

However, the move they are pulling off now, BMN started way back in 2016 and its those moves, that are going to bear the most fruit as this thing all comes together.

So a big congratulations to Largo because it helps compound the very strategy, that BMN had already started.

However, the move they are pulling off now, BMN started way back in 2016 and its those moves, that are going to bear the most fruit as this thing all comes together.

So a big congratulations to Largo because it helps compound the very strategy, that BMN had already started.

Read on Twitter

Read on Twitter