$OZON 70% GROWTH - eCommerce RUSSIA

$OZON 70% GROWTH - eCommerce RUSSIA

Their website gets 63m views EACH MONTH

Their website gets 63m views EACH MONTH COVID boosted eCommerce sales in RUSSIA

COVID boosted eCommerce sales in RUSSIA

Sales grew 70% YoY to $ 866m for first 9 months of 2020

Sales grew 70% YoY to $ 866m for first 9 months of 2020Intrigued? Here is an EASY thread

$OZON is one of the first eCommerce players in Russia  It was founded in 1998 as an online bookstore

It was founded in 1998 as an online bookstore

It quickly expanded to sell CDs, DVDs, clothing and electronics It now offers more than 9m products across 24 product categories

It now offers more than 9m products across 24 product categories

It was founded in 1998 as an online bookstore

It was founded in 1998 as an online bookstoreIt quickly expanded to sell CDs, DVDs, clothing and electronics

It now offers more than 9m products across 24 product categories

It now offers more than 9m products across 24 product categories

Ozon is one of Russia's leading multi-category eCommerce platform  Its Gross Merchandise Value (GMV) expanded 152% in 1H 2020

Its Gross Merchandise Value (GMV) expanded 152% in 1H 2020

It also runs the online travel agency http://Ozon.Travel and holds a stake in Litres, Russia's largest digital books platform

and holds a stake in Litres, Russia's largest digital books platform

Its Gross Merchandise Value (GMV) expanded 152% in 1H 2020

Its Gross Merchandise Value (GMV) expanded 152% in 1H 2020

It also runs the online travel agency http://Ozon.Travel

and holds a stake in Litres, Russia's largest digital books platform

and holds a stake in Litres, Russia's largest digital books platform

Sounds like GROWTH, here is what we’ll look at

What about eCommerce in Russia

What about eCommerce in Russia

Who are the key players

Who are the key players

What are the key challenges to overcome

What are the key challenges to overcome

Why $OZON

Why $OZON

What about eCommerce in Russia

What about eCommerce in Russia

Who are the key players

Who are the key players

What are the key challenges to overcome

What are the key challenges to overcome

Why $OZON

Why $OZON

What about eCommerce in Russia

What about eCommerce in Russia

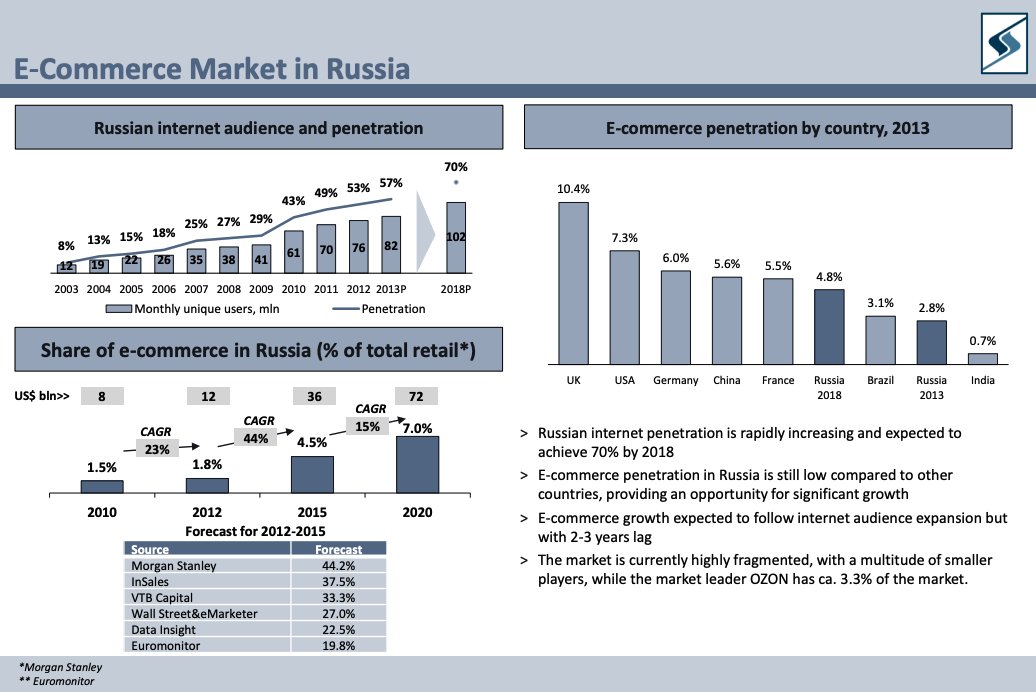

eCommerce penetration is low at 6%, versus 27% for China

eCommerce penetration is low at 6%, versus 27% for China eCommerce makes up 11% of total Russian retail sales - Lower than 16% global average

eCommerce makes up 11% of total Russian retail sales - Lower than 16% global average Russia isn't standing still as eCommerce sales grew 51% YoY during first 6 months of 2020

Russia isn't standing still as eCommerce sales grew 51% YoY during first 6 months of 2020

Furthermore, according to Statista

Sales in the Russian eCommerce market is projected to reach $ 24B in 2020

Sales in the Russian eCommerce market is projected to reach $ 24B in 2020

Sales are expected to grow at 6.1% over 2020 - 2025 period, resulting in sales of $ 32B by 2025

Sales are expected to grow at 6.1% over 2020 - 2025 period, resulting in sales of $ 32B by 2025

Sales in the Russian eCommerce market is projected to reach $ 24B in 2020

Sales in the Russian eCommerce market is projected to reach $ 24B in 2020 Sales are expected to grow at 6.1% over 2020 - 2025 period, resulting in sales of $ 32B by 2025

Sales are expected to grow at 6.1% over 2020 - 2025 period, resulting in sales of $ 32B by 2025

According to Euromonitor

Annual online sales in Russia are expected to grow by more than 40% this year to around RUB 2.5 T ($ 32.5B)

Annual online sales in Russia are expected to grow by more than 40% this year to around RUB 2.5 T ($ 32.5B)

Followed by a 10-15% increase a year over the next five years (2020 - 2025 period)

Followed by a 10-15% increase a year over the next five years (2020 - 2025 period)

Annual online sales in Russia are expected to grow by more than 40% this year to around RUB 2.5 T ($ 32.5B)

Annual online sales in Russia are expected to grow by more than 40% this year to around RUB 2.5 T ($ 32.5B) Followed by a 10-15% increase a year over the next five years (2020 - 2025 period)

Followed by a 10-15% increase a year over the next five years (2020 - 2025 period)

What are underlying drivers?

The pandemic gave a considerable boost as consumers were locked in

The pandemic gave a considerable boost as consumers were locked in

Large headroom for eCommerce penetration also sustain Russia’s online sales rise

Large headroom for eCommerce penetration also sustain Russia’s online sales rise

eCommerce players invest in logistics (e.g. pick up points) and a broader product offering

eCommerce players invest in logistics (e.g. pick up points) and a broader product offering

The pandemic gave a considerable boost as consumers were locked in

The pandemic gave a considerable boost as consumers were locked in Large headroom for eCommerce penetration also sustain Russia’s online sales rise

Large headroom for eCommerce penetration also sustain Russia’s online sales rise eCommerce players invest in logistics (e.g. pick up points) and a broader product offering

eCommerce players invest in logistics (e.g. pick up points) and a broader product offering

This is the case of http://Wildberries.ru , Russia’s eCommerce leader

“The retailer, which says it has over 34 million customers, now has 13 warehouses and dozens of sorting and distribution centres across Russia which reduce delivery times” By Rzhevkina & Marrow for Reuters

“The retailer, which says it has over 34 million customers, now has 13 warehouses and dozens of sorting and distribution centres across Russia which reduce delivery times” By Rzhevkina & Marrow for Reuters

And on the headroom for growth

“The Russian e-commerce market is growing significantly faster than in the United States or in the largest EU countries, thanks to the low penetration base effect” By Data Insight co-founder Boris Ovchinnikov

“The Russian e-commerce market is growing significantly faster than in the United States or in the largest EU countries, thanks to the low penetration base effect” By Data Insight co-founder Boris Ovchinnikov

Here is the full article  https://www.reuters.com/article/us-russia-ecommerce-focus/covid-19-crisis-a-shot-in-the-arm-for-russian-e-commerce-idUSKBN27Z10Z

https://www.reuters.com/article/us-russia-ecommerce-focus/covid-19-crisis-a-shot-in-the-arm-for-russian-e-commerce-idUSKBN27Z10Z

https://www.reuters.com/article/us-russia-ecommerce-focus/covid-19-crisis-a-shot-in-the-arm-for-russian-e-commerce-idUSKBN27Z10Z

https://www.reuters.com/article/us-russia-ecommerce-focus/covid-19-crisis-a-shot-in-the-arm-for-russian-e-commerce-idUSKBN27Z10Z

Who are the key players

Who are the key players

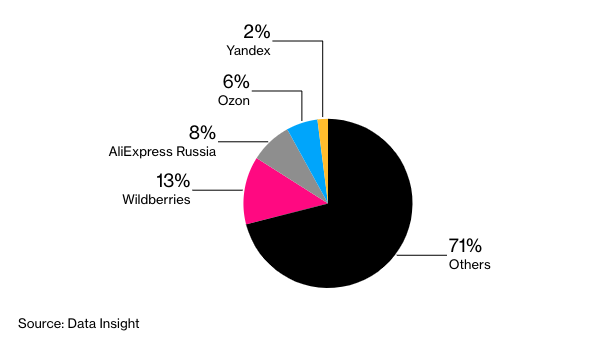

The market is still highly fragmented as the top 3 players only control 18% of the market according to the Financial Times

The market is still highly fragmented as the top 3 players only control 18% of the market according to the Financial Times For comparison, $AMZN controls over 50% of the US market on its own

For comparison, $AMZN controls over 50% of the US market on its own

These 3 Russian players are

http://Wildberries.ru reported $ 1.7B in sales in 2019 and got 139m website visits in Oct ’20

http://Wildberries.ru reported $ 1.7B in sales in 2019 and got 139m website visits in Oct ’20

It grew by 89% in 2018 - 2019 period and controls 9 to 13% of the market

It grew by 89% in 2018 - 2019 period and controls 9 to 13% of the market

http://Wildberries.ru reported $ 1.7B in sales in 2019 and got 139m website visits in Oct ’20

http://Wildberries.ru reported $ 1.7B in sales in 2019 and got 139m website visits in Oct ’20 It grew by 89% in 2018 - 2019 period and controls 9 to 13% of the market

It grew by 89% in 2018 - 2019 period and controls 9 to 13% of the market

http://AliExpress.ru got 112m website visits in Oct ’20 (Sales estimates vary but could be approximated to $ 1B)

http://AliExpress.ru got 112m website visits in Oct ’20 (Sales estimates vary but could be approximated to $ 1B) It grew by 162% in 2018 - 2019 period and controls 6 to 8% of the market

It grew by 162% in 2018 - 2019 period and controls 6 to 8% of the market

Ozon reported $ 832m in sales in 2019 and got 70m website visits in Oct ’20

Ozon reported $ 832m in sales in 2019 and got 70m website visits in Oct ’20 It grew by 87% in 2018 - 2019 period and controls around 6% of the market

It grew by 87% in 2018 - 2019 period and controls around 6% of the marketSources: http://ecommercedb.com http://similarweb.com http://datainsights.ru Reuters

Market shares estimates vary

Market shares estimates vary

Hey there! What is AliExpress exactly?

Remember that Russia is a large country

Remember that Russia is a large country

It touches both the European Union and China

It touches both the European Union and China

Will eCommerce giants from China try to enter the market?

Will eCommerce giants from China try to enter the market?

Remember that Russia is a large country

Remember that Russia is a large country It touches both the European Union and China

It touches both the European Union and China

Will eCommerce giants from China try to enter the market?

Will eCommerce giants from China try to enter the market?

Well, according to Bloomberg & TechCrunch

$BABA teamed up with http://Mail.ru in order to create a Russian eCommerce joint venture: AliExpress

$BABA teamed up with http://Mail.ru in order to create a Russian eCommerce joint venture: AliExpress

http://Mail.ru already delivers online services (social media, email, food delivery) to 100m users

http://Mail.ru already delivers online services (social media, email, food delivery) to 100m users

$BABA teamed up with http://Mail.ru in order to create a Russian eCommerce joint venture: AliExpress

$BABA teamed up with http://Mail.ru in order to create a Russian eCommerce joint venture: AliExpress http://Mail.ru already delivers online services (social media, email, food delivery) to 100m users

http://Mail.ru already delivers online services (social media, email, food delivery) to 100m users

$BABA holds 48% of the venture and http://Mail.ru gets 13% (other backers get the rest) https://techcrunch.com/2018/09/11/alibaba-russia-mail-ru/

$BABA holds 48% of the venture and http://Mail.ru gets 13% (other backers get the rest) https://techcrunch.com/2018/09/11/alibaba-russia-mail-ru/

Before this joint venture, $BABA was managing AliExpress in Russia on its own

However, it was loosing market share because of the long delivery tome for orders from China

However, it was loosing market share because of the long delivery tome for orders from China

It therefore choose to partner with a local partner https://www.bloomberg.com/news/articles/2020-10-20/in-russia-alibaba-baba-yandex-yndx-and-others-battle-for-online-crown

It therefore choose to partner with a local partner https://www.bloomberg.com/news/articles/2020-10-20/in-russia-alibaba-baba-yandex-yndx-and-others-battle-for-online-crown

However, it was loosing market share because of the long delivery tome for orders from China

However, it was loosing market share because of the long delivery tome for orders from China It therefore choose to partner with a local partner https://www.bloomberg.com/news/articles/2020-10-20/in-russia-alibaba-baba-yandex-yndx-and-others-battle-for-online-crown

It therefore choose to partner with a local partner https://www.bloomberg.com/news/articles/2020-10-20/in-russia-alibaba-baba-yandex-yndx-and-others-battle-for-online-crown

Needless to say, eCommerce in Russia is growing FAST and attracting giants such as $BABA

During the April-May period, $OZON recorded a 84% increase in new active buyers YoY

During the April-May period, $OZON recorded a 84% increase in new active buyers YoY

Regions outside of Moscow now accounted for 55% of $OZON gross merchandise value

Regions outside of Moscow now accounted for 55% of $OZON gross merchandise value

During the April-May period, $OZON recorded a 84% increase in new active buyers YoY

During the April-May period, $OZON recorded a 84% increase in new active buyers YoY Regions outside of Moscow now accounted for 55% of $OZON gross merchandise value

Regions outside of Moscow now accounted for 55% of $OZON gross merchandise value

What are the key challenges to overcome

What are the key challenges to overcome

Russia’s main problems lies in the long distances and weak infrastructure

Russia’s main problems lies in the long distances and weak infrastructure The country counts 11 different times zones and stretches over 9,000km (5,600 miles)

The country counts 11 different times zones and stretches over 9,000km (5,600 miles)

eCommerce players are well aware of these challenges

$OZON now has over 200,000 SQM of fulfilment infrastructure across Russia

$OZON now has over 200,000 SQM of fulfilment infrastructure across Russia

It now counts 16,700 pickup points and delivery lockers

It now counts 16,700 pickup points and delivery lockers

Low labor costs help keep prices down as they are building out their logistics

Low labor costs help keep prices down as they are building out their logistics

$OZON now has over 200,000 SQM of fulfilment infrastructure across Russia

$OZON now has over 200,000 SQM of fulfilment infrastructure across Russia It now counts 16,700 pickup points and delivery lockers

It now counts 16,700 pickup points and delivery lockers Low labor costs help keep prices down as they are building out their logistics

Low labor costs help keep prices down as they are building out their logistics

According to http://retail.ru

“Delivery is also optimized by redistributing logistics hubs: companies are betting on cross-regional delivery, moving away from the centralized federal system. This lowers shipping costs and market entry barriers for new companies.”

“Delivery is also optimized by redistributing logistics hubs: companies are betting on cross-regional delivery, moving away from the centralized federal system. This lowers shipping costs and market entry barriers for new companies.”

Continued

“WildBerries and Ozon are planning to open large trade and distribution centers in Yekaterinburg, and the Kazan suburb of Zelenodolsk is also being developed by logisticians from http://Yandex.Market and X5 Retail Group”

“WildBerries and Ozon are planning to open large trade and distribution centers in Yekaterinburg, and the Kazan suburb of Zelenodolsk is also being developed by logisticians from http://Yandex.Market and X5 Retail Group”

Want Under-Hyped stocks directly your inbox?

Don’t MISS any of it, Subscribe NOW https://getbenchmark.substack.com

https://getbenchmark.substack.com

Don’t MISS any of it, Subscribe NOW

https://getbenchmark.substack.com

https://getbenchmark.substack.com

Another challenge for investors is the depreciation of the Rouble

It is no secret that the Russian Ruble (Russian currency) has been under pressure these last years

The exchange rate reached 0.043 USD per Ruble in 2008

The exchange rate reached 0.043 USD per Ruble in 2008

It is no secret that the Russian Ruble (Russian currency) has been under pressure these last years

The exchange rate reached 0.043 USD per Ruble in 2008

The exchange rate reached 0.043 USD per Ruble in 2008

What are the factors behind the fall of the Ruble?

Here is what Tomas Urbanovsky has found

Here is what Tomas Urbanovsky has found

“[…] the decline in global oil prices, which led to the currency crisis in Russia. However, other factors, which might have considerable effects on ruble exchange rate, […]...

Here is what Tomas Urbanovsky has found

Here is what Tomas Urbanovsky has found

“[…] the decline in global oil prices, which led to the currency crisis in Russia. However, other factors, which might have considerable effects on ruble exchange rate, […]...

... FOR example changes in gold and gas prices, Russian interest rates, development of stock market and last but not least development of the USD exchange rate itself.”

We are thus speaking about

Oil prices

Oil prices

Natural gas prices

Natural gas prices

Gold prices

Gold prices

Interest rates

Interest rates

It is very hard to give a strong view on this part, this is a risk for investors

It is very hard to give a strong view on this part, this is a risk for investors

Oil prices

Oil prices Natural gas prices

Natural gas prices Gold prices

Gold prices Interest rates

Interest rates It is very hard to give a strong view on this part, this is a risk for investors

It is very hard to give a strong view on this part, this is a risk for investors

So… This is a lot of information. Let’s summarise

eCommerce penetration in Russia is low at around 11% of total retail sales - coming from 7% pre-Covid

eCommerce penetration in Russia is low at around 11% of total retail sales - coming from 7% pre-Covid

Technology and improved logistics help eCommerce players master key challenges posed by Russian’ geography and climate

Technology and improved logistics help eCommerce players master key challenges posed by Russian’ geography and climate

eCommerce penetration in Russia is low at around 11% of total retail sales - coming from 7% pre-Covid

eCommerce penetration in Russia is low at around 11% of total retail sales - coming from 7% pre-Covid Technology and improved logistics help eCommerce players master key challenges posed by Russian’ geography and climate

Technology and improved logistics help eCommerce players master key challenges posed by Russian’ geography and climate

The eCommerce market is highly fragmented with 4 players having a strong foot: http://Wildberries.ru , Aliexpress, Ozon and Yandex

The eCommerce market is highly fragmented with 4 players having a strong foot: http://Wildberries.ru , Aliexpress, Ozon and Yandex Main risks come from the Ruble’s constant decrease (linked to oil prices amongst other things)

Main risks come from the Ruble’s constant decrease (linked to oil prices amongst other things)

Why $OZON

Why $OZON

The Russian eCommerce market is not in bad shape, but why should we pick $OZON?

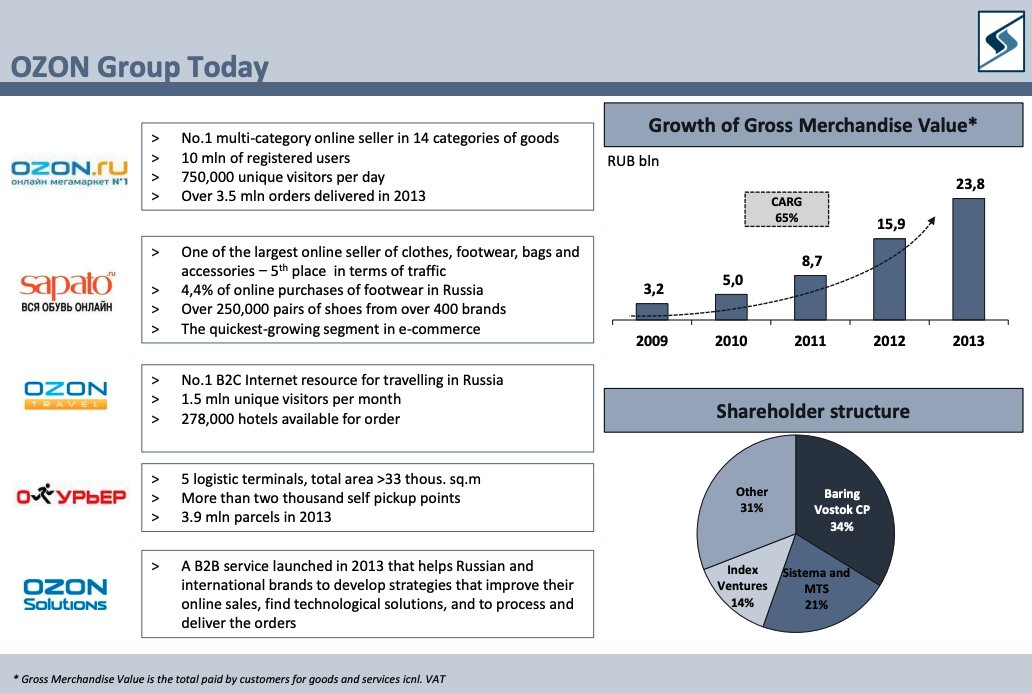

The Russian eCommerce market is not in bad shape, but why should we pick $OZON? Let’s put ourselves in the shoes of Sistema

Let’s put ourselves in the shoes of Sistema  One of Ozon’s largest shareholder

One of Ozon’s largest shareholderHere is what made them invest back in 2014

eCommerce penetration was rising and would reach 7% by 2020 (Spot on!)

eCommerce penetration was rising and would reach 7% by 2020 (Spot on!) Fragmented market providing a golden opportunity for $OZON to stand out

Fragmented market providing a golden opportunity for $OZON to stand out

$OZON was a diversified eCommerce conglomerate active in online retail, logistics and travel

$OZON was a diversified eCommerce conglomerate active in online retail, logistics and travel Gross Merchandise Value was growing fast - From RUB 3.2B in 2009 to RUB 23,8B in 2013

Gross Merchandise Value was growing fast - From RUB 3.2B in 2009 to RUB 23,8B in 2013

And there are many other reasons that led them to invest

If you want more on the 2010 - 2014 period for $OZON , here is an interesting Harvard Business Review piece

https://hbr.org/2014/07/the-ceo-of-ozon-on-building-an-e-commerce-giant-in-a-cash-only-economy

Here is the full deck

http://www.ewdn.com/wp-content/uploads/sites/6/2014/04/ozon_investment_by-Sistema_eng.pdf

If you want more on the 2010 - 2014 period for $OZON , here is an interesting Harvard Business Review piece

https://hbr.org/2014/07/the-ceo-of-ozon-on-building-an-e-commerce-giant-in-a-cash-only-economy

Here is the full deck

http://www.ewdn.com/wp-content/uploads/sites/6/2014/04/ozon_investment_by-Sistema_eng.pdf

But what is $OZON now

$OZON boasts 11.4m active buyers in Q3 ’20, up from 5.3m in Q1 ’19

$OZON boasts 11.4m active buyers in Q3 ’20, up from 5.3m in Q1 ’19

It’s making the switch towards a marketplace and now counts 18.1m active merchants - up from 1.3m in Q1 ’19

It’s making the switch towards a marketplace and now counts 18.1m active merchants - up from 1.3m in Q1 ’19

It scores a NPS of 79! In the same range that $AAPL and $SBUX get

It scores a NPS of 79! In the same range that $AAPL and $SBUX get

$OZON boasts 11.4m active buyers in Q3 ’20, up from 5.3m in Q1 ’19

$OZON boasts 11.4m active buyers in Q3 ’20, up from 5.3m in Q1 ’19 It’s making the switch towards a marketplace and now counts 18.1m active merchants - up from 1.3m in Q1 ’19

It’s making the switch towards a marketplace and now counts 18.1m active merchants - up from 1.3m in Q1 ’19 It scores a NPS of 79! In the same range that $AAPL and $SBUX get

It scores a NPS of 79! In the same range that $AAPL and $SBUX get

Financials Check

Financials Check

Data concerns first 9 months of 2020

Sales grew by 70% YoY to $ 866m with Gross Margins of 30% (up from 19% a year earlier)

Sales grew by 70% YoY to $ 866m with Gross Margins of 30% (up from 19% a year earlier) Operating expenses as % of sales reached 48% down from 51% a year earlier

Operating expenses as % of sales reached 48% down from 51% a year earlier

Largest operating expense is fulfilment and deliveries at 30% of sales

Largest operating expense is fulfilment and deliveries at 30% of sales Loss from operations reached 153m down from a loss of $ 161m a year earlier

Loss from operations reached 153m down from a loss of $ 161m a year earlier Company had $ 66.6m in cash pre-IPO and raised $ 990m during its IPO to fund its expansion https://www.reuters.com/article/us-russia-ozon-ipo-idUSKBN2840OE

Company had $ 66.6m in cash pre-IPO and raised $ 990m during its IPO to fund its expansion https://www.reuters.com/article/us-russia-ozon-ipo-idUSKBN2840OE

THE BOTTOM LINE

THE BOTTOM LINE

eCommerce in Russia is getting a considerable pandemic related boost as consumers had to move online in order to make their purchases

eCommerce in Russia is getting a considerable pandemic related boost as consumers had to move online in order to make their purchases The market is fragmented and requires considerable logistical investment, creating barriers to entry for new players

The market is fragmented and requires considerable logistical investment, creating barriers to entry for new players

$OZON has managed to grow at a very strong pace in its pre-IPO years and continues to deliver YoY sales growth of 70%

$OZON has managed to grow at a very strong pace in its pre-IPO years and continues to deliver YoY sales growth of 70% $OZON is scaling its operations without having to spend big on marketing, with the major share of OpEx going into logistics

$OZON is scaling its operations without having to spend big on marketing, with the major share of OpEx going into logistics

Entry for neighbouring Chinese players needs to be monitored but risk is somewhat mitigated by high infrastructure investments required

Entry for neighbouring Chinese players needs to be monitored but risk is somewhat mitigated by high infrastructure investments required Russian Ruble has been on a downward path for the last years, a risk investors have to bear

Russian Ruble has been on a downward path for the last years, a risk investors have to bear

We take a medium stake in $OZON - 50% of full potential position

We take a medium stake in $OZON - 50% of full potential position

$YNDX is on our watchlist

$YNDX is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Financial Times

✑ Reuters

✑ Staista

✑ Euromonitor

Sources

✑ Investor presentation

✑ Company website

✑ Financial Times

✑ Reuters

✑ Staista

✑ Euromonitor

✑ Data Insights

✑ eCommerceDB

✑ Bloomberg

✑ Harvard Business Review

✑ eCommerceDB

✑ Bloomberg

✑ Harvard Business Review

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter